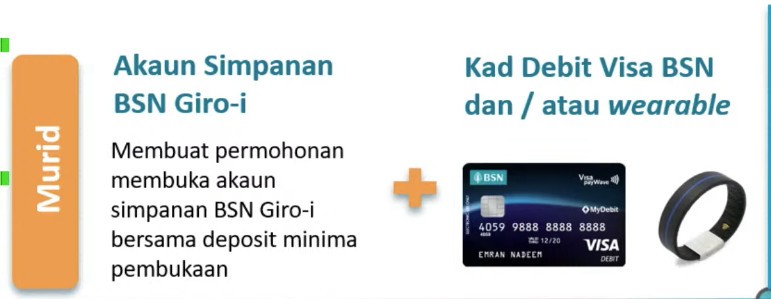

Ahead of the implementation, JPN Perlis has hosted a symposium to discuss the cashless payment system which involved participation from several vendors including Bank Simpanan Nasional (BSN). During its presentation, the bank revealed that it is currently working on a wearable for its Cashless School programme. [Image: BSN / JPN Perlis/ YouTube]The programme, which has been around since 2019, will let schools create BSN Giro-i savings account for students as young as 13 years old instead of the minimum age of 15. Students will be provided with a payWave-enabled Visa debit card and a wearable wristband capable of making cashless payments that are linked directly to their savings account. Parents will be able to electronically transfer funds into the student accounts from any bank account and they will be able to set a daily spending limit. Parents will also be able to monitor their children’s spending as every transaction will be recorded through the MyBSN system. As for safety, BSN did not mention any authentication protocol for the wearable device when making payments but assured that any fraudulent transactions can be traced. On the other side of the spectrum, merchants in the school such as canteens and cooperatives that want to accept cashless payments from students can request payment terminals from the bank which are apparently running on Android and able to support the 5G network. The bank didn’t reveal the actual rollout date for the wearable, so we have no idea how soon BSN will make it available to students. Nevertheless, it will be interesting to see how BSN’s cashless payment wearable will fare against similar devices that Maybank and Visa as well as Touch ‘n Go have worked on in 2016. (Source: JPN Perlis/YouTube, Bernama.)